New York Real Estate Practice Exam

2025 Edition

Take this free New York Real Estate Salesperson Practice Exam with fully explained answers and instant scoring. It will help you prepare for the actual exam administered by the New York Division of Licensing Services. The actual exam has 75 questions and you are given 90 minutes to complete it.

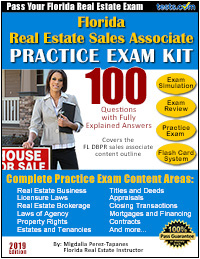

For complete practice of the actual exam, try our 425 Question New York Real Estate Salesperson Practice Exam Kit which includes online Flash Cards, Exam Review and Testing Tips. It Includes 75 New York specific and 350 Core Real Estate questions and answers for a total of 425 Questions - all with fully explained answers.